Educating yourself on saving money as a high school student

Only a small percentage of teens with jobs file their taxes individually.

February 28, 2019

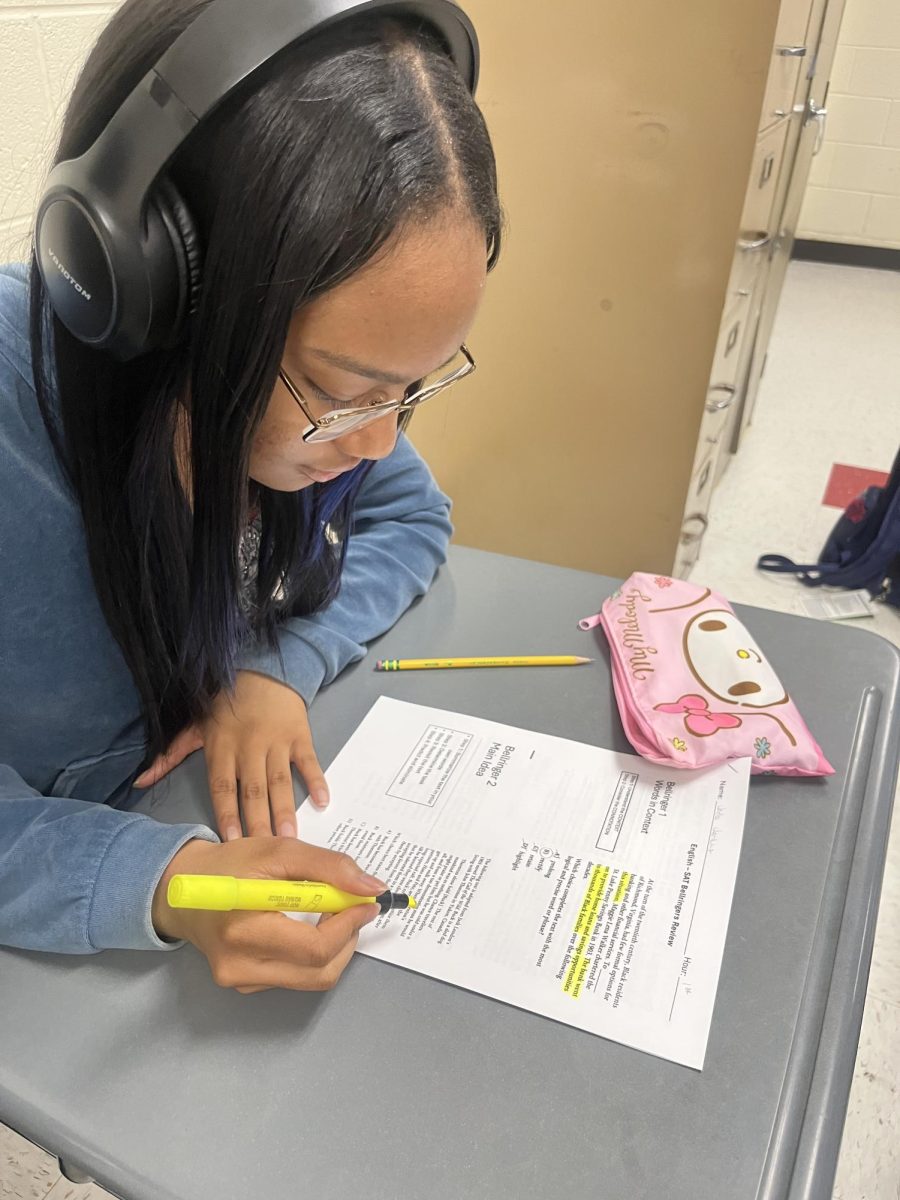

High school is one of the early stages of young adulthood. They are entering that point in their life where their begin to want to start saving their money and begin welcoming financial aid and learning what to do with it.

Teachers and counselors are always trying to give out helpful tips and help us students get the big picture of what it means to save. They often explain to us how much we can benefit by just saving a few dollars a month. Most upperclassmen here at Roseville have jobs if not all. There are even some who uphold two jobs.

Everyone knows that Feb. Mar. and also Apr. is tax time and workers above the age of 15 are able to file their own taxes and receive a refund check. Most people under the age of 18 are often claimed by their parents. While other children file their own taxes and get back the money they had previously paid.

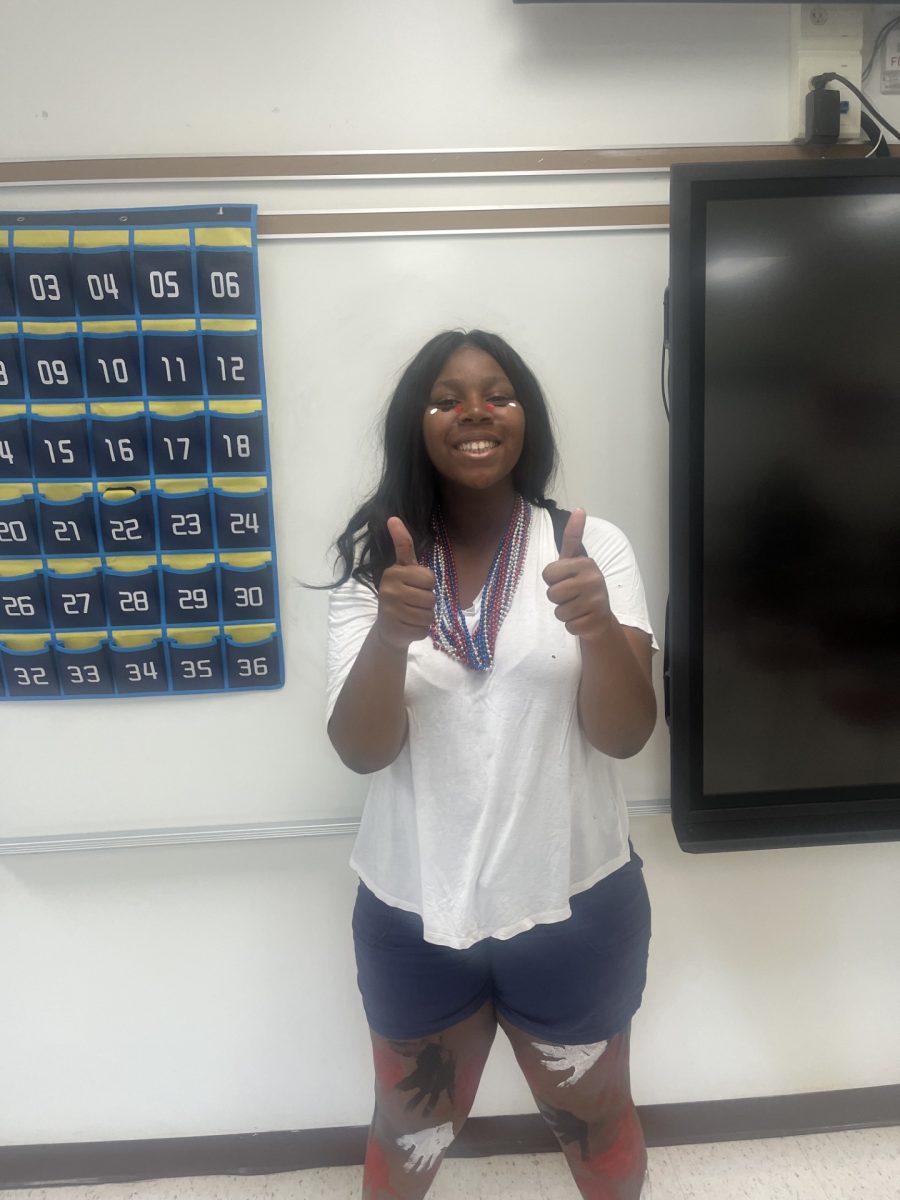

I asked a couple of our upperclassmen if they are filing their taxes and most of them including myself said that either their parents were filing for them or they are being claimed on their parents taxes. I also asked them if they intended on saving their money and what for. Most said that they will save and get ready for prom. Others said they will spend some and save more.“My counselor has taught me so much about getting ready for the future and so has the rest of my teachers and I appreciate them so much for putting me in the mindset of a mature student” senior Briana Moreland Davis said.

The main idea is to get students to understand the importance of saving and opening up a bank account, if not had one before so that they can get the real experience of making and financing their own income.